Some reservations about, and limitations of, the Napoleonic blockade paper on the infant industry argument that’s making waves. (Major caveat to the paper: protection persisted for decades after the blockade and may have helped keep the French cotton industry quite backward relative to Britain.)

Noah Smith had a Bloomberg column on the infant industry argument with a nice mention of Reka Juhasz’s paper on the Napoleonic blockade. It’s long been plausibly argued by historians that Napoleon’s attempt to embargo Britain acted as a kind of de facto protection from British competition for cotton industries across Europe.

Juhasz’s paper deserves the accolades it has received. It is the first truly rigourous demonstration that temporary protection for a fledgling industry can ‘work’ — work in the sense that a country doing the protection can begin to acquire comparative advantage in that sector, and this has long-lasting effects over many decades.

( I’m not exactly sure but I seem to have mixed readership — some readers would know the theoretical rationales behind infant industry protection, and others not. So I have written a bare-bones description of the classical and modern infant industry arguments at the end of this post. )

The Juhasz paper overcomes the endogeneity problem in other research about infant industry protection — the nagging feeling that the government might have chosen an industry which would have become competitive anyway without the protection. The blockade was not intended as a commercial policy, and it was more effective in some parts of the French empire than in others. So Juhasz can exploit the geographical variation in blockade efficacy as a proxy for the regional intensity of British competition.

That ‘exogenous variation’ part of the paper seems to get the most attention, but for me the most interesting is that agglomeration economies played a key role — the change in the spatial pattern of textile production. Initially, before the blockade, French cotton mills were much more widely dispersed across the country than they would prove to be after the blockade. Juhasz demonstrates that those parts of France least exposed to the smuggling of British cotton were the areas where French textile production took off — production in the south was inhibited by Britain’s first mover advantage, whereas the north was protected. This initial locational advantage persisted long after the blockade through path dependence and self-reinforcing cumulative advantages of agglomeration. It’s that switch in spatial concentration from south to north that makes the paper convincing.

{ Edit: Yes, Alsace-Lorraine, along with Mulhouse the “French Manchester” was annexed by Germany in 1871 following the Franco-Prussian War. But the map is about the south-north switch. }

After 1815, France became an exporter of cotton textiles, suggesting some degree of international competitiveness.

I must admit I was sceptical at first. Even in the UK, the first automated Arkwright mills were not tightly concentrated in Lancashire either — they were dispersed across northern England, the Midlands, and Scotland according to water source.

I figured this must also be true for France, but Juhasz controls for natural advantages and her findings are intact. Ironically, water sources or coal deposits were not important partly because French spinning firms relied much more on jennies and mules, which could be powered by hand or animals, than British firms which were more likely to use water- and steam-powered frames or mules.

§ § § § §

I say that’s ironic because, as I pointed out on Twitter, the greater persistence of hand technologies in France could be an effect of protectionism itself !

Although France did become an exporter of textiles after 1815, nevertheless French cloth would still not be competitive with British cloth. In fact, France banned the import of British textiles (both cotton and wool) until the Cobden-Chevalier Treaty of 1860, after which 20-30% tariffs were imposed. (See Nye 1991.) France did not protect its silk and linen industries, which were already competitive with Britain.

The state of technology in the French cotton sector on the eve of Cobden-Chevalier:

The Second Empire was a period of significant change in the textile industry, with cotton textiles the most evident beneficiary. There was increasing use of the steam engine and a consequent expansion in the number of spindles. In the East, 9 out of 100 jennies were automatic in 1856, 80 out of 100 in 1868. The number of spindles went from 320,000 to 464,000 in that same period…”

Normandy, the largest consumer of raw cotton imported from abroad, had few modern factories with relatively few spindles in even the largest firms. The water-powered establishments had difficulty expanding their output and were slow to combine water with steam, which could supplement water power in the winter. Most firms still depended on the old mule-jennies, which were only semi-automatic and required much manual labor.” (Nye 1987)

Now, to be fair, in that paper Nye argues that firm size in France was appropriate for French conditions at the time. But the backwardness of the cotton industry in France circa 1860 is quite striking and the continued protectionism past 1815 must have had something to do with it, even if it is not the full explanation. Also, as Juhasz herself points out citing Saxonhouse & Wright, Britain prohibited the export of machinery and expertise until 1843, so that the diffusion of technology to France might have been obstructed. But I’m sceptical of that argument because I suspect the ban was quite porous, and because the New England textile industry was also more advanced than the French industry.

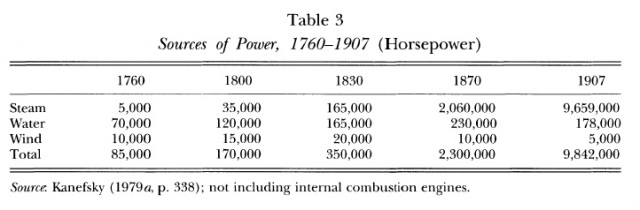

Here’s the contrast with the contemporaneous British use of power:

[Source: Crafts 1994]

( The 1860 policy change [from ban to 20-30% tariffs] might also qualify as a quasi-natural experiment, possibly allowing the estimation of any effect of the liberalisation on technological upgrading in the French cotton industry. There’s a good-sized modern literature on that issue, e.g., Aghion & Burgess, Bustos, etc. )

So you definitely cannot say an effect of the Napoleonic blockade was to make the French cotton industry in 1860 relative to the UK, similar to the Japanese auto industry in 1990 relative to the USA. France could not export cotton textiles to Britain.

Yet one major purpose of the Juhasz paper is to argue it is feasible for the state to promote a modern, increasing-returns-to-scale industry with knowledge spillovers that benefit the rest of society outside the protected sector itself. And Juhasz points out that French per capita import of raw cotton would become as large as Britain’s and bigger than other European countries. But even if the French cotton industry was very large, if it was also relatively unmechanised and backward, then the technological externalities might have been fairly limited.

A classic critique of the infant industry argument is Baldwin (1969), which is mentioned by Noah Smith in his column. Baldwin mostly addresses the ‘appropriability’ issue — the idea that because entrepreneurs can’t appropriate the full benefits of externalities-generating, increasing-returns production, they will undersupply such socially valuable activities. The gist of Baldwin’s critique is that tariff protection doesn’t necessarily alleviate that problem, and the actual history of French cotton seems consistent with that view.

All this also lends support to the political economy critique of the infant industry argument, i.e., the idea that when governments do protect an infant industry, protection often lasts longer than necessary because the state gets captured by political interests benefiting from ‘senile’ industries. I know many people roll their eyes at the rent-seeking critique — and I do agree it’s overused to dogmatically reject reasonable theoretical cases for protection. But the rent-seeking argument is still valid.

I suppose one could argue that a period of continued protection (1815-60) followed by liberalisation was the optimal path. On Twitter Juhasz sort of implied that with this chart:

But 1860 is a pretty late date to have been a technological laggard in cotton. The “Second Industrial Revolution” with steel and chemicals was already beginning in Europe and the United States.

It’s also possible that cotton was not that important as a source of knowledge externalities anyway. Technologically it was a dead-end industry — something argued recently by Kelly & Ó Gráda (2016) — and it may have been the beneficiary of linkages created by other industries more than a creator of its own. The cotton industry certainly wasn’t important as a source of demand for educated labour. See Becker, Hornung, & Woessmann (2011). Therefore, for France at least, you must question how much cotton really contributed to “technological upgrading” at all, relative to other northern Europe.

§ § § § §

Juhasz has replied to what I said on Twitter, acknowledging the political economy issue, but qualifying:

But I don’t think lumping the economic case for infant industry with the [political economy] problems has been conducive to the debate in the past. France [was] not competitive with Britain in cloth, but hard to see how they would have moved into factory based manufacturing so early otherwise. For developing countries I see this as the broader view on what some form of infant industry policy could achieve if done right”.

Let’s call the distinction she makes the “purely econ angle” versus the “historical angle”.

I agree it’s valuable to demonstrate the “purely econ angle” whilst ignoring the “historical angle”. And I acknowledge, so far in this post I’ve focused on the historical question of what eventually happened in France, not on the ahistorical, purely social-scientific issue of what is possible to do with the optimal “intelligent protectionism”.

An ideal infant industry protection, if done right, would be truly temporary protection to provide that “breathing space” until industry achieves some measure of competitiveness, and no more. That is exactly what Juhasz’s paper shows is possible in principle: she manages to show that a discrete event [i.e., the Napoleonic blockade per se], independent of subsequent events, has certain long-term effects [i.e., France possessed a large cotton industry in 1850]. The paper is therefore part of the corpus of historical persistence studies relating some shock in the past with later outcomes.

But the political economy issue has been central to the debate about infant industries. The debate has not been primarily about the “purely econ angle”. Most reasonable people agree that even with import substitution industrialisation, there was growth and structural transformation in developing countries. (The question is only how much of that growth can really be attributed to ISI, as opposed to other factors, such as the favourable global environment of the 1945-73/80 which I will call the LDC “trente glorieuses”. Also none of that growth ever amounted to any appreciable unconditional convergence with the rich countries.)

The political economy dimension was certainly stressed by the 1970s-80s Krueger-Bhagwati-Balassa critiques of trade policies in developing countries. They argued that the duration and the form of protection were endogenous to politics and institutions. What gets protected, for how long, and in what form are not decided in a political vacuum. (James Robinson argues the same, but in more ‘updated’ ways.) Krueger, Bhagwati, and Balassa emphasised the effect of politically decided policies on currency overvaluation and the negative effective rates of protection for exporters. So, in their argument, political economy considerations were directly related to the inward orientation and anti-export bias of ISI.

But I won’t elaborate because I’m going to write a post about ISI soon.

Postscript: Some theoretical rationales for infant industry protection

{ This is for readers who may not know about these rationales. }

Contrary to popular stereotype, mainstream economics does not a priori rule out things variously described as “infant industry protection” or “industrial policy”. Abundant theoretical rationales for such things can be found at the intersection of endogenous growth theory, strategic trade theory, and new economic geography.

Everyone acknowledges that the spillover benefits (positive externalities) of technology are very large. If your country has a computer industry, this implies formal as well as tacit knowledge that’s embodied in people and organisations whose benefits spill outside that specific industry. So even the service sector benefits from the country’s ability to create PayPal or Just in Time inventory control.

When you have positive externalities, the social return to producing some good exceeds the private return, and that’s a good thing for society, but it is a market failure which keeps the rate of investment lower than it could be. Private investors anticipate there is excess return which cannot be appropriated and they will undersupply that good.

( Or so the story goes. I think that theory must be qualified by the Industrial Revolution. Many key inventors like Hargreaves and Crompton didn’t seem to care, even ex ante, about capturing any chunk of the social value of their work. They more or less gave away their inventions. Other inventors like Arkwright were plagued by piracy and mired in patent infringement cases at court. But that’s for another day. )

Hence, the question naturally arises whether the state should promote technology which might be expected to generate knowledge spillovers. Most people don’t object to subsidies for research and development. But many people do object if the promotion entails restrictions on international trade or direct subsidies to businesses.

In the classic infant industry argument, a domestic industry is prevented by established, more efficient foreign producers with first-mover advantage from getting off the ground during the initial high-cost phase of production. Since you still need your factory, machinery, and work force in order to produce a single unit of output, the high fixed cost of merely starting up production can only be amortised by increasing the scale of production.

Besides, even if the world’s cutting-edge technology and best practises drop from the sky onto your lap, these must still be adapted to local conditions. You learn to reduce costs and produce at frontier efficiency levels only by actually doing the production. This practical experience generates the techniques and improvements to production methods which are not easily codified and must reside in the brains of people — what in the Industrial Revolution literature is often called “tacit knowledge”, “micro-inventions”, and “local learning”.

So firms in the start-up industry need “breathing room” to get up to speed. Otherwise they might get wiped out by foreign competitors before they’ve had the chance to mature. In this theoretical setup, temporary protection is justified since there’s latent comparative advantage to draw out.

In the debate about antebellum US tariffs, it’s generally not about whether the New England cotton industry could have survived the full force of British competition. Rather the debate is between those who think it could have survived tariff-free after 1830 or after 1850. (cf. Irwin & Temin 2001 versus Harley 1992, 2001). David (1973) argued learning-by-doing effects were an important part of how and when New England became competitive, as production costs declined even without significant changes in machinery.

A more modern form of the infant industry argument incorporates the so-called Marshallian externalities, or agglomeration economies. If learning-by-doing is a process internal to the firm, then the clustering of many firms — a large industry — generates ‘external’ benefits from collective learning. (And agglomeration economies figure prominently in the Juhasz paper.)

Firms locate nearest their largest markets, their labour force, and their suppliers, but they also cluster amongst other firms like themselves. More of them there are in an industry, more knowledge is generated which cannot be contained within a single firm. Knowledge spills over, as skilled workers move between firms or set up their own shop; ideas and techniques are stolen and pirated; and firms simply demonstrate to one another what’s possible to do. It’s not only things like inventions which diffuse in the network of firms, but also all that practical experience and tacit knowledge.

And then there are linkages aka “pecuniary externalities”. If the industry is bigger (for example, due to tariffs or subsidies), there is more specialisation in different value-added stages of production. During the Industrial Revolution, you could say a bigger cotton industry made it more likely to get more specialist machine makers, more specialist textile printers, more specialist weavers, etc. And all this lowers unit costs.

There are many other possible rationales. I haven’t mentioned the Big Push. And I’ve barely touched on the implications of scale. The post-bellum USA, Wilhelmine Germany, post-war Japan, and South Korea all built cartelised, highly capital-intensive industries like steel and autos. They used a protected domestic market to help pay for the massive fixed costs of starting up production through high prices and monopoly rents, and when unit costs fell enough they started exporting. For a small-ish country like South Korea, this strategy could not have succeeded without exporting to another country like the USA that was not very picky about trade reciprocity… (Noah Smith asked me on Twitter who might have modelled this, and I think Krugman did in the early 1980s, but I have to check.)

By the way, I agree industrial policy should also pass the welfare test. But when it comes to development in poor countries, I don’t put much stock in static welfare considerations — people tend to be hyperbolic discounters and industrial policy should be seen as forced savings/investment for the really really really long haul. Their revealed preferences suggest they don’t care all that much about their descendants anyway! Hell, according to Banerjee and Duflo, even physically stunted and malnourished people often blow extra income on expensive festivals! It’s normal to want fun in the dreary here and now… So I prefer to examine industrial policy arguments for developing countries on the grounds of effectiveness of intervention as well as institutional & state capacity problems. And human capital. That’s quite neglected when it comes to industrial policy debates in LDCs. In the industrial policy literature connected with trade & development, there’s just way too much emphasis on skills & knowledge externalities generated by promoted industries, as opposed to the knowledge and skill created by formal schooling.

Filed under: Infant industry argument, international trade, protectionism Tagged: cotton, Infant industry argument, Napoleonic blockade, Reka Juhasz