Germany experienced little increase in unemployment during the Great Recession, and has found “internal devaluation” relatively easy and pain-free, unlike most other countries. Why ? Some observations on the role of social capital in financial crises.

Theoretically, a drop in general demand in the economy would not necessarily have to result in unemployment, if businesses were willing or able to reduce their costs by cutting everyone’s pay, rather than sacking a part of the workforce. An alternative to a general pay cut would be to reduce everyone’s work hours, which still result in lower incomes for individual workers. But in the real world, neither scenario happens because:

- firms don’t want to demoralise their entire work force by cutting everyone’s pay, rather than quickly firing a large minority of the workforce they won’t ever see again ; and/or

- unions and/or labour regulations may constrain businesses from acting in this way, especially for lower-skilled workers ; and/or

- firms may want to keep the best workers and get rid of the worst, and a general pay cut will encourage the best to leave even in a recession.

Even if there is unemployment, wages do not fall quickly in response to the excess supply of workers (nominal wages are ‘sticky’) for many reasons, one of which is that a mismatch between old and new jobs may persist in the economy. It takes time for unemployed programmers and bankers to retrain as lawyers and master-carpenters, or adjust expectations downward and become cooks and taxi drivers. So waiting for wages to come down in order to clear the labour market or get rid of unemployment is a painful process. Government policies can shorten or prolong it, but one way or another it almost always takes longer than anyone wants.

The point is, if the adjustment in a recession could take place primarily through a proportionate reduction in everyone’s incomes, rather than through the unemployment of a large minority, the pain of recession could be widely shared rather than concentrated and the recession itself might also be shortened. But basically that ‘pain-sharing’ never happens, because it cannot. There’s a coordination failure in the economy as a whole.

( Note : Keynesians [the older generation kind] would dispute the preceding paragraph, but I preemptively wave away the objection. The subject here is “internal devaluation” in a highly open economy, and general nominal wage reduction in a single country is partial-equilibrium in the world economy at large, so even Keynesians should be okay with it. )

A useful simplification of the dilemmas facing an open economy in a recession is the Swann diagram (adapted from here) :

The intersection of the two curves is the sweet spot of internal and external balance, where both internal and external balances are zero. If you have high unemployment and a budget deficit, you need to borrow that fiscal shortfall from the bond market, or the IMF, or a generous benefactor. But if you can’t borrow or there are limits to borrowing, then you must cut back on spending or raise taxes (i.e., austerity) and make everything worse. A country which controls its own currency can devalue it and create a trade surplus, which can soften the blow of austerity (at least as long as your trade competitors don’t return the favour with a devaluation of its own).

But if you cannot conduct a sovereign monetary policy, then all your adjustment must be internal, i.e., as Andrew Mellon allegedly advised Herbert Hoover, “liquidate labor, liquidate stocks, liquidate farmers, liquidate real estate… it will purge the rottenness out of the system. High costs of living and high living will come down… Values will be adjusted, and enterprising people will pick up from less competent people…” Mellon was colourfully arguing for “internal devaluation”, i.e., essentially the same idea as a fire sale in a buyer’s market with an unsold inventory of cars or a glut of new houses.

But “internal devaluation” is prolonged and painful. The primary and fastest lever of alleviating recessions — monetary policy — is disabled by things like the gold standard of the 19th century, or the euro of today. The pain of adjustment-through-recession might be alleviated, even avoided, if everyone could “share the pain”, rather than a select group of people be unemployed. But that just does not happen, because it cannot — except in Germany.

§ § §

It’s easy to forget now, but in the mid to late 1990s, Germany was derided along with France as one of the sick men of Europe. While the United States elated in economic triumphalism as its unemployment rate reached a historic low of 3.9%, the rates in the ‘big’ economies of Western Europe were mired in the 10-12% range, with Spain at even higher levels. And most of these economies were not in recession. As a cure for Eurosclerosis many argued for the implementation of Thatcher-like restructuring, with big tax cuts, big reductions in state spending, deregulation, and retrenchment of the welfare state.

In the case of Germany, following reunification it spent hundreds of billions of Deutschmarks to boost the eastern states — along the lines of 4% of West German GDP annually between 1991 and 1999. [source] This did not fully close the gulf between east and west, but German costs did rise, competitiveness was eroded, and Germany’s structural unemployment remained high.

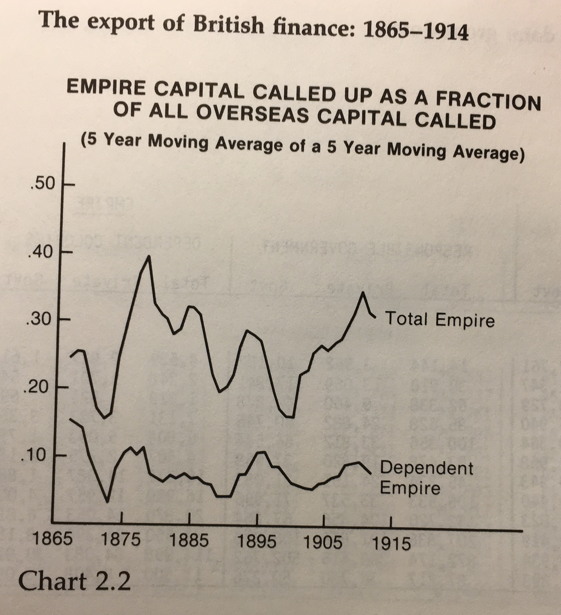

Some time in the late 1990s, something changed within the German economy, and it was definitely a supply-side event, i.e., Germany’s labour costs began to fall relative to its trading partners’. Here’s an international comparison of unit labour costs, or wages relative to productivity [source], with 1995=100 :

For a high-wage country like Germany which had been reputed for labour rigidity, that’s a pretty steep rise in international competitiveness ! Germany accomplished an internal devaluation, which eventually paid off in a reduction of the unemployment rate :

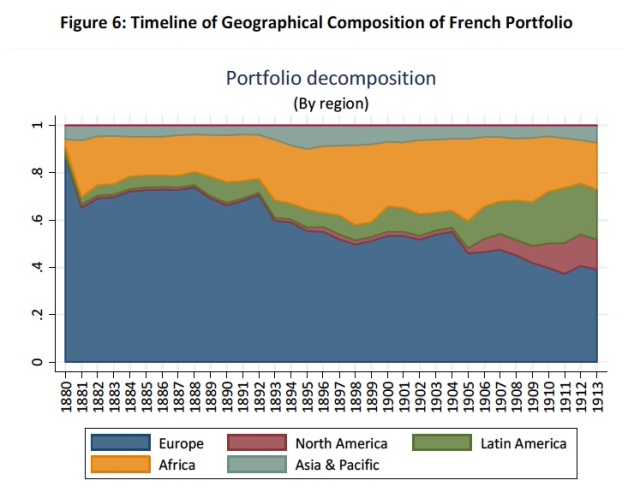

as well as a big rise in Germany’s external surplus [in % of GDP, source : S. Wren-Lewis] :

These effects are often attributed to a series of reforms collectively known as the “Hartz plan” implemented between 2003 and 2005. They were a mixed bag of legislations enabling low-wage “mini-jobs“, curbing early retirement options and (most controversially, in Hartz IV) reducing long-term unemployment benefits. The Hartz reforms must have done something to reduce structural unemployment, especially for younger and older workers, if only by reducing unemployment benefits. That seems a reasonable interpretation, but it is in fact disputed by many people (e.g., 1, 2, 3).

Since at least half the improvement in German competitiveness predates those reforms by nearly 10 years, there must be other important reasons.

§ § §

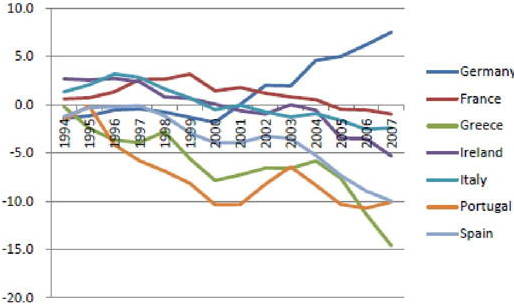

Even more interesting is that Germany’s recession in 2008-9 was quite shallow in terms of unemployment, i.e., the pain was “widely shared”. Although GDP contracted more in Germany than the USA or France,

the German unemployment rate barely blinked [both charts from here] :

But why ? In the 2008-9 recession, in response to falling orders, German firms reduced labour utilisation by cutting back work hours rather than by laying off workers. In fact, a whopping 90% of the drop in total labour inputs in the German economy in the Great Recession is to be explained by reduction of hours per worker ! This kind of “labour hoarding” does not normally happen during recessions in other countries, but did happen in Germany this time. This mini-miracle now has people on the centre-left all over the world seeking ways to replicate it in other countries, and has spawned a substantial literature.

In Germany, firms face restrictions on sacking workers in the first place, but in case of economic difficulties, they can apply to the Federal Employment Agency (Bundesagentur für Arbeit) for “short time” or Kurzarbeit. (Not the same as the 35-hour work week made famous by France, which is a statutory definition of full-time work.) The application entails a protocol for reducing work hours per worker, with the request triggering a process of consultations between the BA, management and works councils inside firms. After an agreement, workers can receive unemployment compensation in proportion to the loss in working hours. (There are great many more details, but they are really boring.)

There are sceptics who argue the effect of the Kurzarbeit system is exaggerated and the muted response of the German labour market to the Great Recession was due to the wage restraint of 1999-2008. Also, there had been a shortage of skilled labour which German manufacturers would not want to lose even in a recession. There’s some reason to think this is at least partially correct. Parts of the Kurzarbeit system go back as early as the late 19th century. In previous recessions, German firms had actually always resorted to hours-reduction more than in other countries. For example, during past recessions in the USA, ~30% of the reduction in labour inputs has been “intensive”, via adjustment of hours, whereas in Germany it has been ~60%. (source)

§ § §

An explanation which best accounts for the dramatic rise in Germany’s competitiveness after the mid-1990s, that’s also consistent with its amazing labour market flexibility during the Great Recession, is contained in Dustmann et al. The argument hinges on a major institutional characteristic of Germany’s. Since it’s impossible to describe an industrial governance structure with charts or data, I simply quote from them [emphases mine]:

…the specific governance structure of the German system of industrial relations offers various margins of flexibility. In the early to mid 1990s, these institutions allowed for an unprecedented increase in the decentralization (localization) of the process that sets wages, hours, and other aspects of working conditions, from the industry- and region-wide level to the level of the single firm or even the single worker, which in particular helped to bring down wages at the lower end of the wage distribution. This decentralization took place even though the institutional setup of the dominating system of industry-wide wage bargaining basically remained unchanged.

The specific feature which we stress here is that the governance structure of the German system of industrial relations is not rooted in legislation and is not governed by the political process, but instead is laid out in contracts and mutual agreements between the three main labor market parties: trade unions, employer associations, and works councils (the worker representatives who are typically present in medium-sized and large fifirms).7 For this reason, Germany was in the position to react in an unprecedented way to the challenges of the early 1990s.

[7] Works councils have to be set up in establishments with more than five employees when demanded so by the employees. About 92 percent of employees in establishments that have more than 50 employees work in establishments with a works council, but only 18 percent of employees in establishments that are smaller…

The principle of autonomy of wage bargaining is laid down in the German constitution and implies that negotiations take place without the government directly exerting influence. As such, Germany has had no statutory minimum wage imposed by the political process over the period we study. Rather, an elaborate system of wage floors is negotiated periodically between trade unions and employer associations, typically at the industry and regional level.

…As a consequence, negotiations are usually far more consensus-based and less confrontational than in other countries. For example, Germany lost on average 11 days of work each year per 1,000 employees by strikes and lock-outs between 1991 and 1999, but only five days per 1,000 employees between 2000 and 2007. These figures for the earlier and later time period compare to 40 and 32 days per 1,000 employees in the United States, 30 and 30 days in the United Kingdom, 73 and 103 days in France, 158 and 93 days in Italy, and 220 and 164 days in Canada…

In Germany, contractual agreements between unions and employer associations are negotiated either on the region-industry level or on the firm level. In addition to wages, working time regulations are an important component of the negotiations.

A distinguishing feature from US labor market institutions is that the recognition of trade unions in Germany is at the discretion of the firm, and union contracts cover only the workers in firms that recognize the relevant sectoral wage bargaining (union) contract—regardless of whether the worker is a union member…

Also, German firms that once recognized the union contracts can later opt out at their own discretion. Even within union wage contracts negotiated at the industry level, there is scope for wage flexibility at the firm level through so-called “opening” or “hardship” clauses, provided that workers’ representatives agree…

After opting out of a collective agreement, firms still have to pay wages for the incumbent employees according to the collective agreement until a new agreement at the firm level has been reached, but they do not have to honor new negotiated wage increases and the firm need not follow the old collective agreements for new hires. Thus, over time a firm may be able to lower wage costs considerably by opting out of the union contract—provided its employees accepted this.

[ The Economist also had a really readable piece on a similar theme, an intimate portrait of how worker-management relations work inside a German company to maintain both quality and competitiveness. ]

Within a minimal institutional framework set up by statute, it is left up to workers and management to work things out themselves. Dustman et al.’s argument is equivalent to saying, Germany’s wage restraint [relative to productivity growth] since the 1990s was a natural, ‘market’ outcome of negotiations between management and labour in response to the erosion of competitiveness after German reunification. (Of course, it did help with the employers’ bargaining position with workers that part of their production could now be offshored to Eastern Europe after 1989.)

Most European countries have copied aspects of the “social partnership” model of ‘codetermination’ between government, business, and labour which in Germany is known as Betriebsverfassungsgesetz. But imitation has not produced similar results, and some countries have a more decentralised system of ‘co-determination’ than others. In France and some Mediterranean countries, the state frequently intervenes in the bargaining between business and labour, because (I would argue) there’s a much more adversarial relationship between labour and business. Contrast with the Anglosphere — it also has an adversarial relationship between business and labour, but then it has relatively few labour protections/regulations and basically no coordination of bargaining.

To simplify a little bit, the Anglosphere has social conflict and the state intervenes relatively little in the bargaining process; but in France and the Mediterranean, there is more social conflict and there is more state intervention. In Emmanuel Todd‘s scheme, the Anglosphere is individualistic and non-egalitarian, but France is individualistic and egalitarian. In the latter, the state must arbitrate and ‘fix’ things.

§ § §

The relatively decentralised labour market institutions of Germany and the other northern countries reflect their lower level of social conflict. Germany, Austria, Switzerland, Denmark, Norway, Sweden, and Finland are well known for their efficient labour markets despite what, from an Anglo-Saxon perspective, should look like rigidities. And these same countries also do not have statutory minimum wage laws but still manage to have the de facto equivalent — wage floors set by bargaining between workers and management.

[The Netherlands, with its “Polder model“, also belongs in the list of decentralised bargaining countries, but it does have a minimum wage law. By the way, Germany has just recently passed a minimum wage law.]

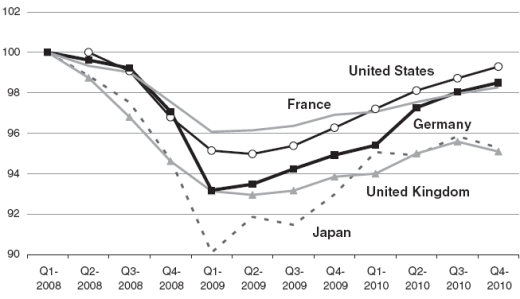

Is it a coincidence that the northern Eurozone had a curiously parallel experience of the Great Recession (source) ?

Initially, the northern Eurozone countries experienced a similar, or deeper, crash in GDP than the southern countries ; yet their unemployment rates barely moved. [In the above, France is included in the “southern economies” even though it’s really intermediate between the two. So the southern economies actually look worse if France is excluded.]

So can this system be duplicated elsewhere ? I say no. In the Anglosphere it requires too many constraints on business than is currently regarded as politically and culturally palatable. In Europe outside the northern economies the constraints are regarded as too few ! The decentralised system of ‘co-determination’ is likely something that can only exist in societies with a lot of social capital, i.e., those which are cooperative, consensus-prone, and high-trust.

That social capital also shows up in the political system. A Swedish blogger who specialises in personality psychology explains how a “feminine personality” manifests itself in a “consensus democracy” :

The other main aspect of femininity, cooperation, is something that is found in the political systems of these countries. The Feminine region is characterized by consensus democracy, especially in the sense that these countries have proportional electoral system, lots of political parties that form coalitions and with the ambition of getting broad support for decisions, not just within coalitions but with opposition and other interest groups and institutions. It’s the friendly, inclusive, and cooperative way of governing.

In contrast, the Anglosphere is characterized by the majoritarian model (see the link above) in which countries have fewer parties, form less coalitions with often just a single party in government at a time. The government also focuses more on their own agenda with less concern for and compromise with other parties, interest groups etc. It’s the competitive and take-charge way of governing.

Calling it ‘majoritarian’ actually understates the winner-take-all approach of the competitive model in the Anglosphere. Not a single government in the UK has received a majority of the popular vote since before the war, and the last time one came even within the upper 40s was in the 1950s. Yet, because of a combination of single-branch government and first-past-the-post voting, a plurality party in the UK can attain power and not necessarily achieve consensus in society even when implementing fairly radical legislation (e.g., Thatcher, who never got more than 42-43% of the vote).

In France, Thatcher would have been impossible simply because of the absolute-majority voting system. But even if a Thatcherite came to power with >50%, there would have been blood in the street from the minority out of power ! Of course the first few years of Thatcherism also provoked unrest in the UK, but one imagines it would be far worse in France with its long history of labour agitation and at-the-drop-of-a-hat demos.

§ § §

Within the Eurozone, Germany’s current account surpluses have been a problem, which even the IMF and the US Treasury have criticised. But these surpluses were caused by internal devaluation — something almost nobody ever does voluntarily or accomplishes without pain. Germany’s labour market reforms, especially Hartz IV, are unpopular and, by German standards, pretty divisive. But they took place without massive social cost and without an extraordinary, compelling urgency, such as an external debt or a balance of payments crisis. I just can’t imagine something comparable taking place in France without triggering unrest even with a major emergency.

The ultimate cause of Germany’s problematic strength in the Eurozone is not an authoritarian culture, or primordial savings behaviour, or economic unilateralism, but its amazing institutional capacity and social capital. Surely that is as impressive as any feat of German engineering, or as exceptional as the logistical efficiency with which Germans of the past waged two-front wars.

Filed under: Financial Crises, International Monetary Economics, Social & Civic Capital Tagged: current account, Emmanuel Todd, Euro, Eurozone, financial crisis, France, Germany, Hartz

Before PET, glass bottles had been used for beverages, but obviously these were pretty heavy, easily broken, and very expensive to transport. And glass bottles require a very high fixed investment to manufacture, so scale was required to make production worthwhile. Other kinds of plastics (PVC, polypropylene,

Before PET, glass bottles had been used for beverages, but obviously these were pretty heavy, easily broken, and very expensive to transport. And glass bottles require a very high fixed investment to manufacture, so scale was required to make production worthwhile. Other kinds of plastics (PVC, polypropylene,  HDPE, LDPE, etc.) failed to pass muster on numerous grounds : too rigid, too brittle, not food-grade, too heavy, or opaque. Some of these, however, are still used for milk, motor oil, laundry detergents, etc.

HDPE, LDPE, etc.) failed to pass muster on numerous grounds : too rigid, too brittle, not food-grade, too heavy, or opaque. Some of these, however, are still used for milk, motor oil, laundry detergents, etc.

The high-end equipment are manufactured by French, Japanese, and German companies. At the lower end, there are — of course ! — hundreds of Chinese equipment manufacturers, almost all of them located in a single county of a single province, supplying bottle-making machines of various grades. Africa is full of “semi-automatic” Chinese machines.

The high-end equipment are manufactured by French, Japanese, and German companies. At the lower end, there are — of course ! — hundreds of Chinese equipment manufacturers, almost all of them located in a single county of a single province, supplying bottle-making machines of various grades. Africa is full of “semi-automatic” Chinese machines.

vividly and brilliantly illustrated with ice water and a $1 vise by the physicist Richard Feynmann. As part of the commission to investigate the explosion of the

vividly and brilliantly illustrated with ice water and a $1 vise by the physicist Richard Feynmann. As part of the commission to investigate the explosion of the

Markandya is aware of this :

Markandya is aware of this :